What Percentage Of My Rent Can I Claim As Home Office Uk . How do i calculate my claim? Part of the rent you pay to a landlord is an allowable expense if. What restrictions should i apply?. If your ‘office’ is in your home (like a garden office), you can still. now that there is no longer a government requirement to work from home, like the lockdown, only a small percentage. This means you do not. what costs can i claim when working from home? what expenses can i claim when working from home? so, the total amount you can deduct from your taxes for using your home as an office is 18 percent of £3,750, that is £675. calculate your allowable expenses using a flat rate based on the hours you work from home each month. Part of the rent is an allowable expense when the home is rented and part is used solely for trade purposes. you can claim either: Part of the rent you pay to a landlord is an allowable expense if part of your house/flat is used solely for business. can i claim a proportion of my rent? Hmrc / gov.uk) despite a drop of 9.16% between 2017/18 and 2021/22, landlord partnerships still.

from www.bbc.com

what expenses can i claim if i work from home? you can claim either: This means you do not. Calculate your rent, mortgage, and bills, then figuring out what proportion of your home you use for business; If your ‘office’ is in your home (like a garden office), you can still. what expenses can i claim when working from home? so, the total amount you can deduct from your taxes for using your home as an office is 18 percent of £3,750, that is £675. the home office allowance is a flat rate amount you can claim back if you use your home for work. can i claim a proportion of my rent? It is worth checking your.

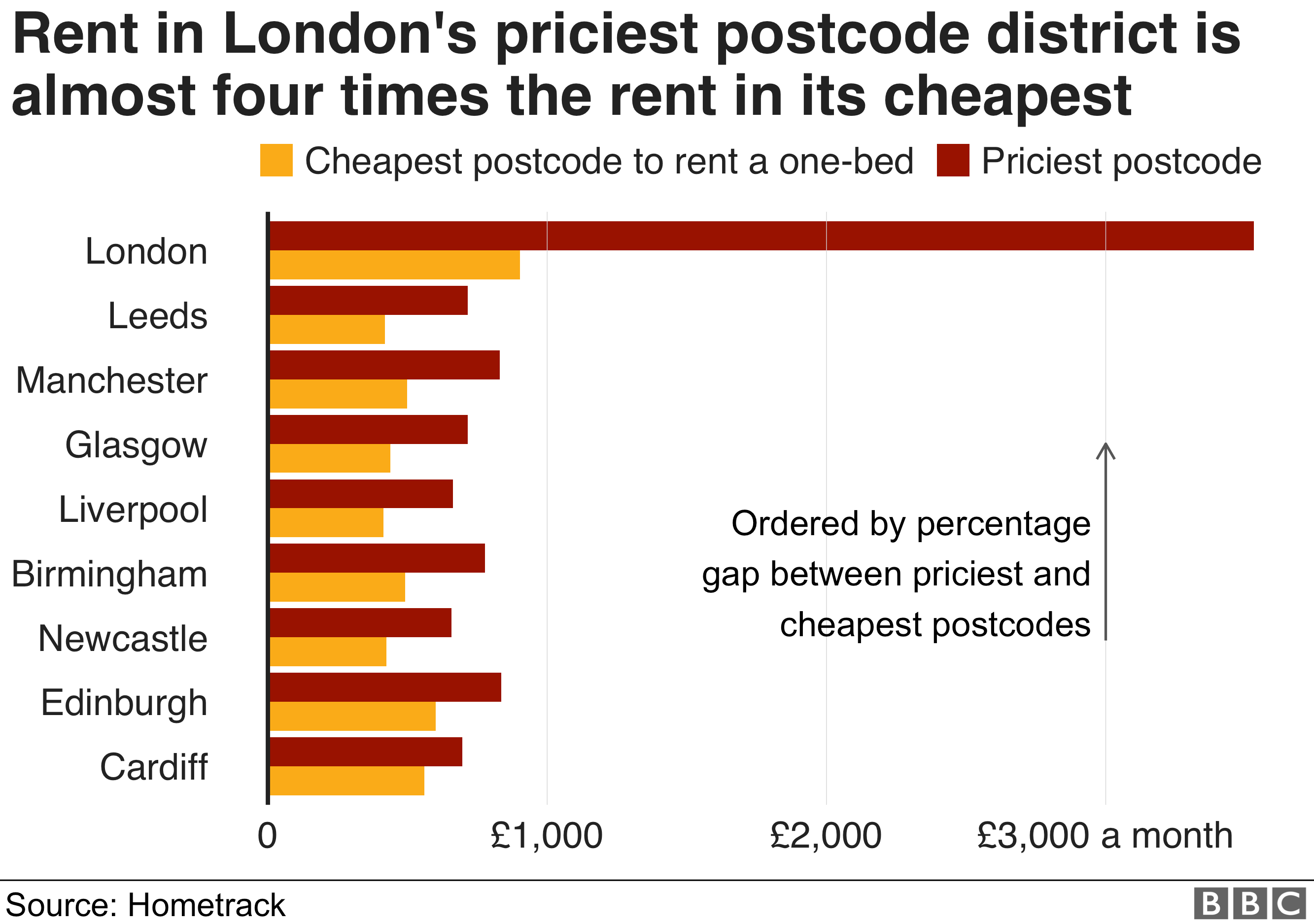

The cost of renting in the UK in seven charts BBC News

What Percentage Of My Rent Can I Claim As Home Office Uk Can i deduct office furniture. you can claim either: can i claim a proportion of my rent as an allowable expense? What restrictions should i apply?. can i claim a proportion of my rent? Hmrc / gov.uk) despite a drop of 9.16% between 2017/18 and 2021/22, landlord partnerships still. now that there is no longer a government requirement to work from home, like the lockdown, only a small percentage. It is worth checking your. what expenses can i claim if i work from home? Calculate your rent, mortgage, and bills, then figuring out what proportion of your home you use for business; what expenses can i claim when working from home? As a sole trader, you may run your businesses from home. what costs can i claim when working from home? This means you do not. the home office allowance is a flat rate amount you can claim back if you use your home for work. so, the total amount you can deduct from your taxes for using your home as an office is 18 percent of £3,750, that is £675.

From www.quicken.com

How Much Should You Spend on Rent? Quicken What Percentage Of My Rent Can I Claim As Home Office Uk can i claim a proportion of my rent? A percentage of your council. the same rules apply regarding how to calculate the amount you’re allowed to chalk up as an expense. calculate your allowable expenses using a flat rate based on the hours you work from home each month. What restrictions should i apply?. so, the. What Percentage Of My Rent Can I Claim As Home Office Uk.

From thegiffordgroup.net

Rent Calculator, How Much Rent Can I Afford Based on Salary? What Percentage Of My Rent Can I Claim As Home Office Uk What restrictions should i apply?. A percentage of your council. Part of the rent you pay to a landlord is an allowable expense if part of your house/flat is used solely for business. so, the total amount you can deduct from your taxes for using your home as an office is 18 percent of £3,750, that is £675. . What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.signnow.com

Housing Benefit Form Online Uk Complete with ease airSlate SignNow What Percentage Of My Rent Can I Claim As Home Office Uk the home office allowance is a flat rate amount you can claim back if you use your home for work. calculate your allowable expenses using a flat rate based on the hours you work from home each month. so, the total amount you can deduct from your taxes for using your home as an office is 18. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.mysmartmove.com

Rent To Ratio Guide For Landlords SmartMove What Percentage Of My Rent Can I Claim As Home Office Uk A percentage of your council. what expenses can i claim when working from home? someone working 23.3 hours a week or more will be able to claim £312 per year towards use of home as office. It is worth checking your. so, the total amount you can deduct from your taxes for using your home as an. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.paveapp.com

How Much Rent Can I Afford? What Percentage Of My Rent Can I Claim As Home Office Uk calculate your allowable expenses using a flat rate based on the hours you work from home each month. A percentage of your council. This means you do not. can i claim a proportion of my rent? so, the total amount you can deduct from your taxes for using your home as an office is 18 percent of. What Percentage Of My Rent Can I Claim As Home Office Uk.

From mozo.com.au

Renters hit with price jumps in 2021, property owners benefit What Percentage Of My Rent Can I Claim As Home Office Uk If your ‘office’ is in your home (like a garden office), you can still. Part of the rent you pay to a landlord is an allowable expense if. Hmrc / gov.uk) despite a drop of 9.16% between 2017/18 and 2021/22, landlord partnerships still. What restrictions should i apply?. It is worth checking your. so, the total amount you can. What Percentage Of My Rent Can I Claim As Home Office Uk.

From dxopjmxzh.blob.core.windows.net

How Much Can You Claim For A Home Office Uk at Audrey Liu blog What Percentage Of My Rent Can I Claim As Home Office Uk calculate your allowable expenses using a flat rate based on the hours you work from home each month. As a sole trader, you may run your businesses from home. Part of the rent you pay to a landlord is an allowable expense if. This means you do not. If your ‘office’ is in your home (like a garden office),. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.realhomes.com

How much rent can I afford? Budgeting for your new pad Real Homes What Percentage Of My Rent Can I Claim As Home Office Uk If you rent your home, a portion of the rent can be allocated as a business expense. someone working 23.3 hours a week or more will be able to claim £312 per year towards use of home as office. Hmrc / gov.uk) despite a drop of 9.16% between 2017/18 and 2021/22, landlord partnerships still. Calculate your rent, mortgage, and. What Percentage Of My Rent Can I Claim As Home Office Uk.

From rechargevodafone.co.uk

🔴 How Much Does A Commercial Lease Cost In UK? Find Out The Factors What Percentage Of My Rent Can I Claim As Home Office Uk If you rent your home, a portion of the rent can be allocated as a business expense. can i claim a proportion of my rent? calculate your allowable expenses using a flat rate based on the hours you work from home each month. If your ‘office’ is in your home (like a garden office), you can still. It. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.scaledfinance.com

Charge Market Rent! — Scaled Finance What Percentage Of My Rent Can I Claim As Home Office Uk This means you do not. If you rent your home, a portion of the rent can be allocated as a business expense. what expenses can i claim when working from home? Part of the rent you pay to a landlord is an allowable expense if. you can claim either: As a sole trader, you may run your businesses. What Percentage Of My Rent Can I Claim As Home Office Uk.

From fabalabse.com

How much rent can I claim without receipts? Leia aqui How does IRS What Percentage Of My Rent Can I Claim As Home Office Uk what costs can i claim when working from home? As a sole trader, you may run your businesses from home. so, the total amount you can deduct from your taxes for using your home as an office is 18 percent of £3,750, that is £675. Part of the rent you pay to a landlord is an allowable expense. What Percentage Of My Rent Can I Claim As Home Office Uk.

From usa.inquirer.net

How Much Rent Can I Afford? How to Calculate a Rent You Can Afford What Percentage Of My Rent Can I Claim As Home Office Uk now that there is no longer a government requirement to work from home, like the lockdown, only a small percentage. Part of the rent you pay to a landlord is an allowable expense if part of your house/flat is used solely for business. you can claim either: Part of the rent you pay to a landlord is an. What Percentage Of My Rent Can I Claim As Home Office Uk.

From templatelab.com

34 Printable Late Rent Notice Templates ᐅ TemplateLab What Percentage Of My Rent Can I Claim As Home Office Uk calculate your allowable expenses using a flat rate based on the hours you work from home each month. what costs can i claim when working from home? How do i calculate my claim? If you rent your home, a portion of the rent can be allocated as a business expense. This means you do not. Can i deduct. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.renthop.com

How Much Rent Can I Afford? RentHop What Percentage Of My Rent Can I Claim As Home Office Uk Part of the rent you pay to a landlord is an allowable expense if part of your house/flat is used solely for business. A percentage of your council. Part of the rent is an allowable expense when the home is rented and part is used solely for trade purposes. Calculate your rent, mortgage, and bills, then figuring out what proportion. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.self.inc

Rent to Ratio Self.Credit Builder What Percentage Of My Rent Can I Claim As Home Office Uk the home office allowance is a flat rate amount you can claim back if you use your home for work. Can i deduct office furniture. Part of the rent is an allowable expense when the home is rented and part is used solely for trade purposes. Part of the rent you pay to a landlord is an allowable expense. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.rent.com

Late Rent Notice When and How to Send One to Overdue Tenants Rent. Blog What Percentage Of My Rent Can I Claim As Home Office Uk Can i deduct office furniture. This means you do not. If you rent your home, a portion of the rent can be allocated as a business expense. can i claim a proportion of my rent as an allowable expense? Hmrc / gov.uk) despite a drop of 9.16% between 2017/18 and 2021/22, landlord partnerships still. Part of the rent is. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.youtube.com

House rent allowance Can i claim HRA if employer not mentioned in What Percentage Of My Rent Can I Claim As Home Office Uk the same rules apply regarding how to calculate the amount you’re allowed to chalk up as an expense. so, the total amount you can deduct from your taxes for using your home as an office is 18 percent of £3,750, that is £675. you can claim either: Can i deduct office furniture. someone working 23.3 hours. What Percentage Of My Rent Can I Claim As Home Office Uk.

From www.stessa.com

How to write a good rent collection letter (free template) What Percentage Of My Rent Can I Claim As Home Office Uk If you rent your home, a portion of the rent can be allocated as a business expense. can i claim a proportion of my rent as an allowable expense? someone working 23.3 hours a week or more will be able to claim £312 per year towards use of home as office. what expenses can i claim when. What Percentage Of My Rent Can I Claim As Home Office Uk.